Financial Services cloud for your business

Salesforce Financial Services Cloud provides a tailored platform that helps financial institutions move from a transaction-based model to one centered on long-term client relationships. By unifying disparate data and processes, it enables professionals across banking, wealth management, and insurance to deliver personalized and proactive service while maintaining compliance.

Unifying Client Data for Holistic Advice

For wealth and asset management firms, the platform consolidates all of a client's financial information—from investment accounts and retirement plans to banking products and insurance policies—into a single, comprehensive view. This "client 360" allows advisors to see the total household value, understand complex family relationships and financial goals, and identify new opportunities. Armed with this holistic view, advisors can provide proactive, personalized advice that strengthens trust and helps clients achieve their life goals.

Streamlining Client Onboarding and Referrals in Banking

Retail and commercial banks leverage Financial Services Cloud to dramatically improve the client lifecycle. The platform streamlines the onboarding process with guided workflows, ensuring all necessary documentation and compliance checks (like KYC and AML) are completed efficiently. It also provides robust tools to track and manage referrals from different lines of business—for example, a personal banker referring a client for a mortgage or a wealth consultation—ensuring a warm handover and a seamless client experience across the entire institution.

Personalizing Policyholder Engagement for Insurance

Insurance carriers and agents use the platform to gain a complete picture of each policyholder. It provides a unified view of all policies, claims, life events, and service interactions in one place. This allows agents to identify coverage gaps, anticipate future needs based on life events (like a marriage or new home purchase), and provide more personalized service. By understanding the entire client relationship, insurers can improve retention and position themselves as trusted advisors for all of life's milestones.

Managing Regulatory Compliance and Client Communication

Across all financial sectors, maintaining compliance is paramount. Financial Services Cloud includes features designed to help firms meet their regulatory obligations. It provides a clear audit trail of all client interactions, from emails to meeting notes, which can be captured and archived. This ensures that advisors can document their client communications and demonstrate that their advice is suitable and in the client's best interest, simplifying audit preparations and mitigating risk.

Empowering Advisors with Actionable Insights

The platform surfaces critical tasks and opportunities directly on the advisor's dashboard. For example, it can alert an advisor to a client's upcoming birthday for a personal touchpoint, flag a large cash deposit that could be an investment opportunity, or create a task to review a maturing CD. By proactively highlighting these key moments, Financial Services Cloud helps advisors stay engaged with their entire book of business, ensuring no client is overlooked and no opportunity is missed.

Financial services cloud features

Salesforce Financial Services Cloud is built on a specialized data model that tailors the world's #1 CRM to the specific needs of financial institutions. It provides dedicated features for different sectors, including retail banking and insurance, to help professionals manage complex relationships and streamline industry-specific processes.

Features for Retail Banking

Customer 360 for Banking

This feature provides a holistic, 360-degree view of every retail banking customer. Bankers can instantly see a client's personal details, financial accounts (checking, savings, loans, credit cards), household relationships, and recent interactions in one consolidated profile. This complete context allows for more personalized conversations and helps bankers anticipate customer needs.

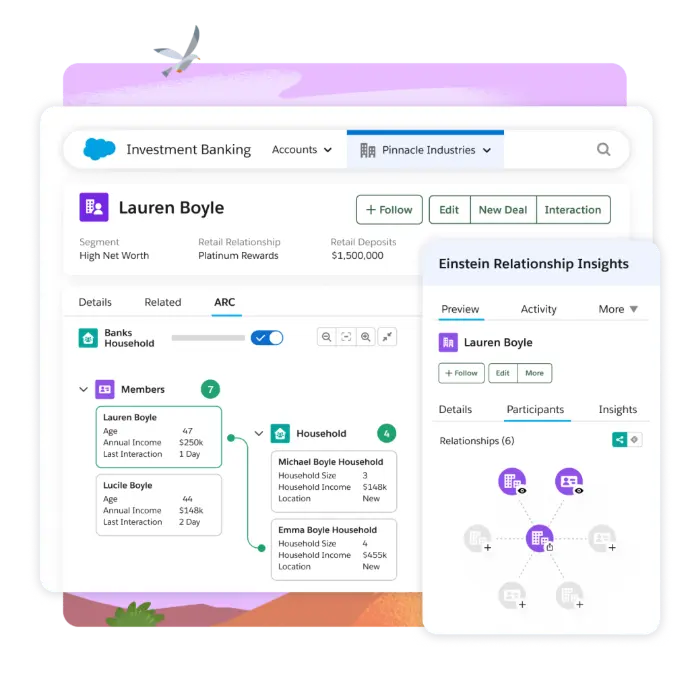

Actionable Relationship Center (ARC)

ARC offers a dynamic and graphical way to visualize and explore complex customer relationships. A banker can see how a single customer is connected to a household, other family members, or business entities. This helps uncover networks of influence and identify referral opportunities across different lines of business, such as wealth management or mortgage lending.

Financial Goals and Needs-Based Referrals

Bankers can capture and track a customer's life goals, such as saving for a home, funding an education, or planning for retirement. Based on these identified goals and the customer's financial profile, the system provides intelligent, needs-based referral capabilities. This feature streamlines the process of connecting customers with specialists within the bank (e.g., loan officers, financial advisors) ensuring a warm handover and a seamless experience.

Branch Management and Banker Productivity

This set of features is designed to help manage branch operations and individual banker performance. Branch managers can get insights into their branch's productivity, track customer appointments, and manage their team of bankers and tellers. Individual bankers can manage their book of business, track their goals and referrals, and get alerts for key customer moments, like maturing CDs or large deposits.

Features for Insurance

Insurance Agent Console

This is the command center for insurance agents and service representatives. The console is specifically designed for the insurance industry, providing a unified view of policyholders, their policies, claims, life events, and related activities. This allows agents to have all the critical information at their fingertips during any client interaction.

Policy and Claims Management

Financial Services Cloud provides a comprehensive data model to track detailed policy information, including coverages, beneficiaries, premiums, and renewals. It also allows for the management of the entire claims lifecycle, from First Notice of Loss (FNOL) to settlement. Agents can see a policyholder’s complete claims history alongside their active policies, offering a true 360-degree view.

Life Events and Milestones

This feature allows agents to capture and act on significant events in a policyholder's life, such as getting married, having a child, buying a home, or starting a new job. By tracking these milestones, the system can proactively prompt agents to reach out with relevant advice and identify potential cross-sell or upsell opportunities for new types of coverage, fostering a more proactive and valuable client relationship.

Distributor Performance Management

For insurance carriers that work with independent agents or brokers, the platform includes tools to manage these distribution channels. Carriers can track the performance of their distributors, analyze key metrics like policy sales and renewal rates, and provide their partners with the data and support they need to be successful. This helps strengthen the carrier-distributor relationship and drive sales growth.

Financial Services Cloud implementation

Implementing Salesforce Financial Services Cloud requires a deep understanding of the financial services industry and a meticulous approach to data, compliance, and user adoption. At ASC digital, our methodology is designed to de-risk your project and ensure the platform is configured to meet the specific needs of your advisors, bankers, or agents, ultimately creating a unified and client-centric operation.

Presales

Our engagement begins with a strategic conversation about your firm's specific goals. In the presales phase, we seek to understand your key challenges, whether it's breaking down data silos, improving advisor productivity, or meeting complex regulatory requirements. We discuss your current technology landscape and client relationship model to articulate how Financial Services Cloud can provide a clear return on investment, tailored to your unique position in the wealth management, banking, or insurance sectors.

Discovery

This is the foundational stage where we create the blueprint for your entire implementation. Through intensive workshops with your stakeholders, we map out your client processes, from onboarding and householding to financial account aggregation and referral management. We dive deep into your data sources and define the specific configurations needed for compliance and reporting. The outcome is a detailed solution design that precisely documents how the platform will be tailored to support your business processes and drive advisor efficiency.

Build

With the detailed blueprint as our guide, our certified consultants configure your Financial Services Cloud environment. This technical phase is handled with the utmost attention to security and detail. We configure the specialized financial services data model, set up custom record types for different client segments, and build out the Actionable Relationship Center (ARC) to visualize client households. We implement automation for tasks like referral tracking and create tailored console layouts to give your team a 360-degree view of every client.

Testing

Before going live, we conduct rigorous User Acceptance Testing (UAT) focused on industry-specific scenarios. We guide your team through testing key processes, such as verifying the accuracy of financial account roll-ups, validating referral workflows between departments, and ensuring compliance rules are correctly applied. This phase is critical for ensuring data integrity and confirming that the system operates exactly as required, giving your team full confidence in the platform's capabilities.

Delivery

The delivery phase marks the transition of your firm onto its new, client-centric platform. Our team manages a secure and seamless go-live process, including the careful migration of sensitive client and financial data from legacy systems. We deliver comprehensive training sessions designed specifically for the roles of your financial professionals, focusing on how the new tools will enhance their daily workflow and client interactions. Our goal is to empower your team for immediate productivity and platform adoption.

Hypercare

Our commitment to your success extends beyond the launch. We provide a dedicated hypercare period of post-launch support to ensure a smooth transition for your team. During these critical first weeks, our experts are on standby to offer immediate assistance, troubleshoot any user inquiries, and resolve issues swiftly. This intensive support solidifies user confidence, ensures the platform is stable and effective, and helps your firm begin realizing the value of its investment right away. Implementing Salesforce Financial Services Cloud (FSC) requires a specialized approach that respects the nuances of the financial industry, including its complex data relationships, regulatory demands, and the critical importance of client trust. At ASC digital, our implementation methodology is designed to address these unique challenges, ensuring a solution that is not only powerful and compliant but also drives advisor productivity and deepens client relationships.

Presales

Our engagement begins with a strategic conversation about your firm's specific objectives. Whether you are in wealth management, banking, or insurance, we listen to understand your key challenges—be it streamlining client onboarding, achieving a 360-degree household view, or enhancing compliance protocols. We discuss how FSC’s specialized data model and features can directly address these needs, establishing a clear vision for success and the tangible ROI you can expect from your investment.

Discovery

This phase is a meticulous deep dive into your operations and regulatory landscape. We conduct collaborative workshops with your advisors, bankers, agents, and compliance officers to map your distinct processes and data requirements. We focus on critical FSC elements, such as defining household structures, financial account types, and client relationship groups. This blueprinting stage is paramount for defining how we will configure the platform to your exact specifications while ensuring data integrity and adherence to compliance standards.

Build

With a comprehensive blueprint in hand, our certified consultants begin constructing your FSC environment. This is where the specialized features come to life. We configure the client and household data models, set up financial account objects, and build out the Actionable Relationship Center (ARC) to visualize complex connections. We implement custom workflows for client onboarding, referral management, and create Action Plans for standardizing processes like annual reviews. Throughout the build, we ensure every configuration is scalable, secure, and aligned with your firm’s unique way of doing business.

Testing

Given the sensitive nature of financial data, our testing phase is exceptionally rigorous. We work with your team to perform User Acceptance Testing (UAT) that validates every aspect of the platform against real-world scenarios. Advisors test creating and managing client households, bankers test the referral workflow, and compliance teams verify that data visibility and sharing rules function correctly. This ensures the system is not only technically sound but also trusted by the people who will use it every day.

Delivery

Go-live for Financial Services Cloud is a carefully managed event. Our team handles the secure migration of your client and financial data, deploying the finalized configurations into your production environment. A cornerstone of this phase is user training tailored to the specific roles within your firm. We ensure your advisors, personal bankers, and support staff are not just proficient in navigating the system, but also understand how to leverage its powerful features to enhance their productivity and client interactions from day one.

Hypercare

Our commitment to your success extends beyond the launch. We provide a dedicated hypercare period of intensive, post-launch support. Our team remains on high alert to provide immediate assistance, troubleshoot any issues, and guide your team as they begin managing live client data in the new system. This focused support ensures a smooth transition, builds user confidence, and solidifies the adoption of a platform that will serve as the foundation for your client relationships and growth.

What improvements do you need for your organization? Our team is here to offer expert advice. Book a call